Always ahead with Fi/Co

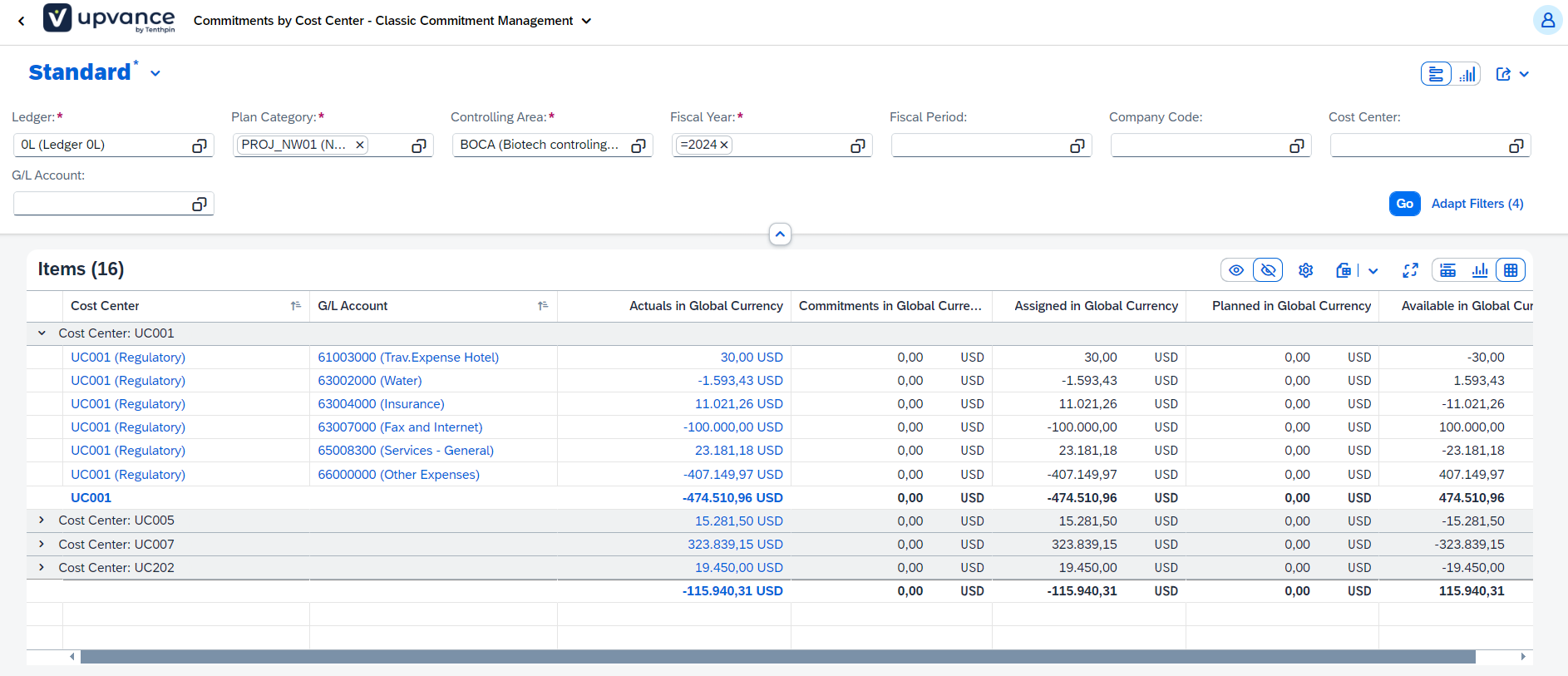

Upvance’s Finance module deals with overall financial reporting and accounting, while Controlling focuses more narrowly on planning and monitoring costs.

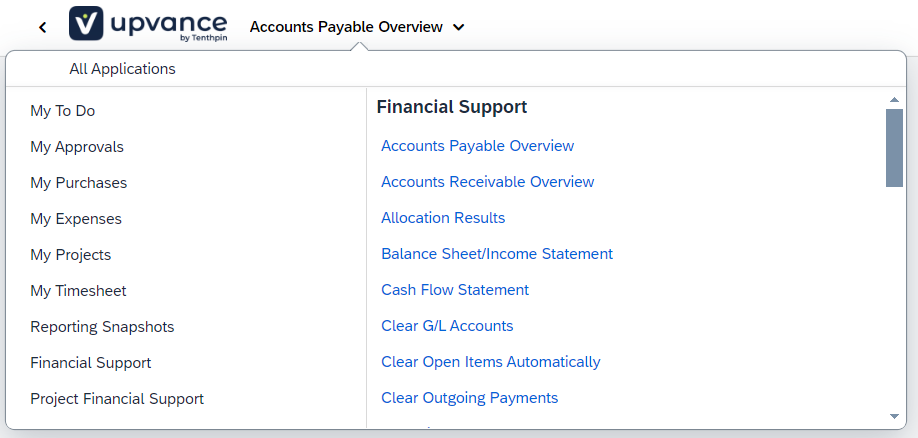

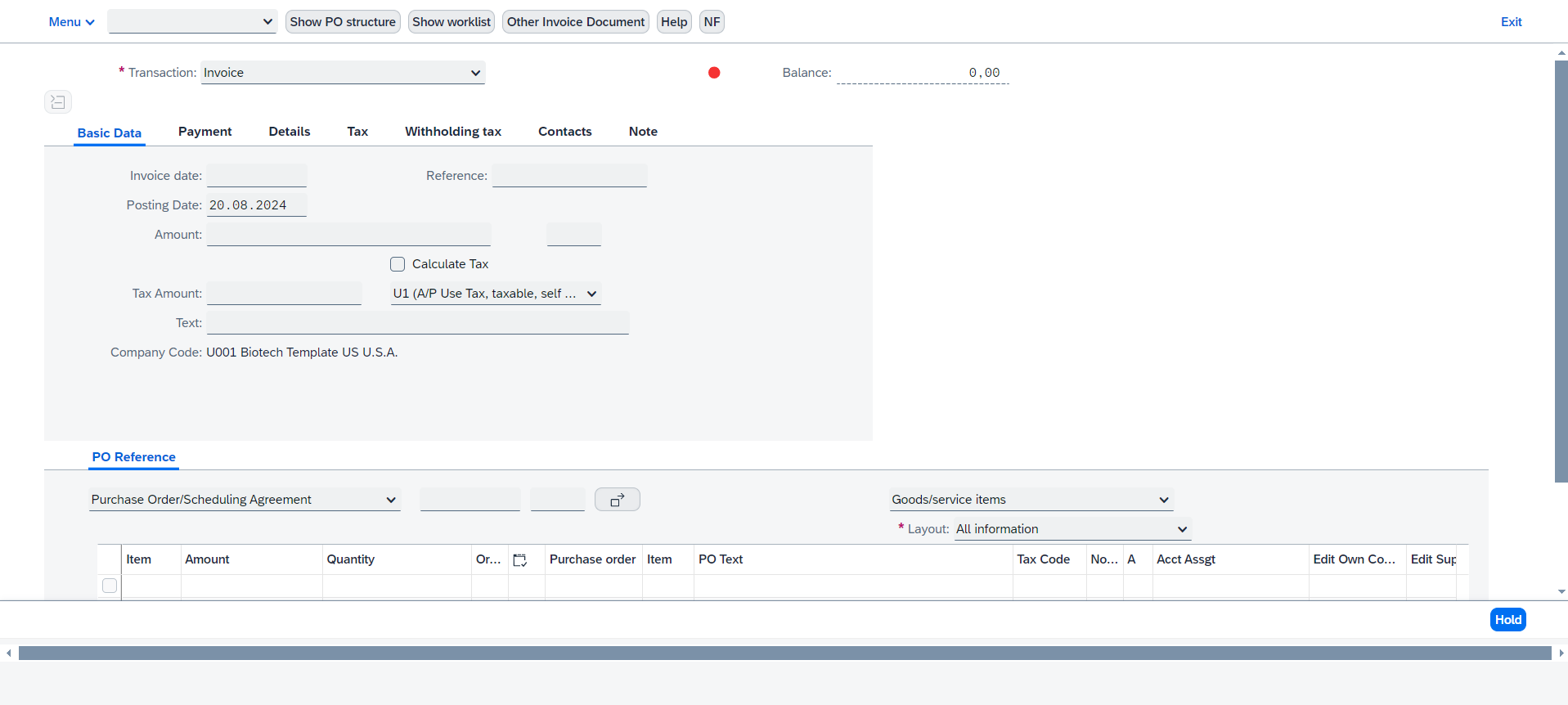

pvance’s Finance and Controlling (FICO) offers a comprehensive suite of functionalities that streamline financial management and enhance operational efficiency. Key features include robust financial accounting (FI) capabilities, such as general ledger, accounts receivable, accounts payable, and asset accounting, ensuring accurate and real-time financial reporting. The controlling (CO) module supports internal management processes with cost center accounting, profit center accounting, enabling precise cost tracking.

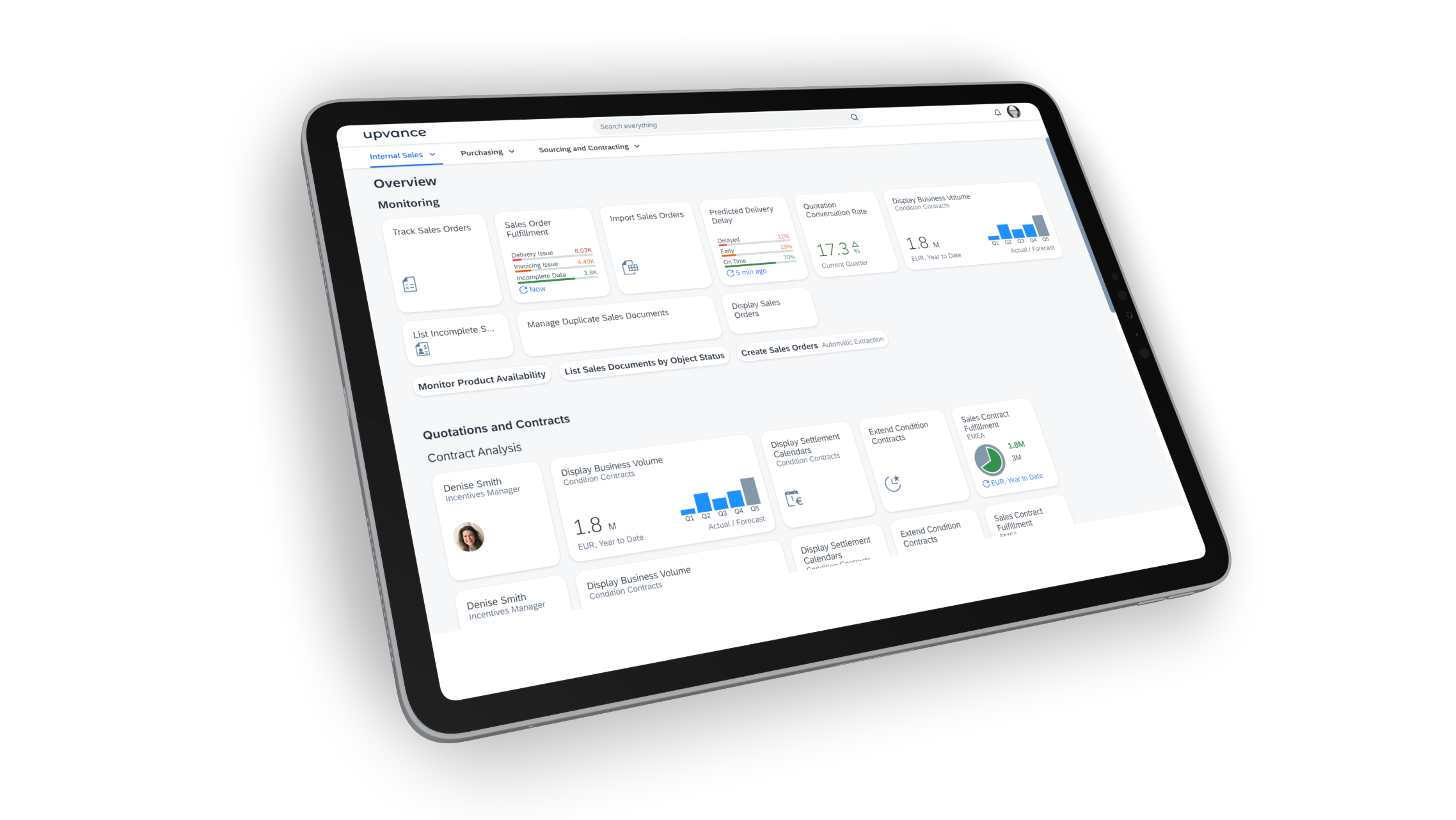

The seamless integration with Purchasing, Project Management, personal expense and timesheet recording, real-time data processing, and advanced analytics empower your organization to make informed financial decisions, optimize resource allocation, and drive more strategically your operations.

Upvance supports different accounting principles, including US GAAP and IFRS, by offering flexible financial reporting and accounting functionalities. It allows businesses to manage multiple sets of books simultaneously, enabling parallel accounting and compliance with various standards. Features such as customizable financial statements, automated postings, and comprehensive reporting tools ensure accurate and transparent financial management. Upvance also facilitates the consolidation of financial data across different entities, ensuring consistency and compliance with both US GAAP and IFRS. This capability helps your organization to meet regulatory requirements and maintain robust financial control.

The platform Upvance will also support your company with revenue recognition and expense accruals through its advanced financial management capabilities. It allows for accurate and timely recognition of revenue in compliance with various accounting standards. The system automates the process of recognizing revenue based on performance obligations, contract terms, and delivery milestones. Additionally, it facilitates expense accruals by enabling the timely recording of incurred expenses, even if invoices have not yet been received. This ensures that financial statements reflect a true and fair view of your company’s financial position, supporting better decision-making and regulatory compliance.

Knowing how your Biotech gets growing:

One platform to accelerate your business